Quito Mifos Chapter Helps Promote National Financial Inclusion Policy

On August 22, 2017, representatives of the Mifos chapter of Ecuador, participated in an event held by Red de Instituciones Financieras de Desarrollo (RFD) to impact the broader financial inclusion community in Ecuador. This project seeks to promote a space for the construction of a National Financial Inclusion Policy, under a broad concept that is not only limited to access and use of financial services, but also proposes the creation of an adequate environment, both in the regulatory sphere, and in enhancing the capacities of the population through financial education, under criteria of protection to the financial user.

These essential pillars of Financial Inclusion, implemented in a joint way, will have a greater probability of impact on sectors excluded populations, to generate processes of economic growth and employment

Quito Chapter president, Jorge Moncayo, participated on this panel whose objective was to have a space for dialogue and proposal by key actors in the process of constructing the national policy for financial inclusion in order to know their criteria and mechanisms of contribution in relation to the proposal presented by RFD. The 60 minute discussion was moderated by Yamile Pinto – Chief of Institutional Strengthening of RFD who conduct two rounds of questions for participants at the table with the following approach:

- What is your analysis regarding the current situation of Financial Inclusion in Ecuador and against this what is your criterion regarding this initiative to have a national policy?

- How would their organizations be inserted in the process of construction of this national policy? What would be your contributions and / or proposals in this construction process?

After the two rounds of questions there was an open space of interaction with the audience for approximately 20 minutes.

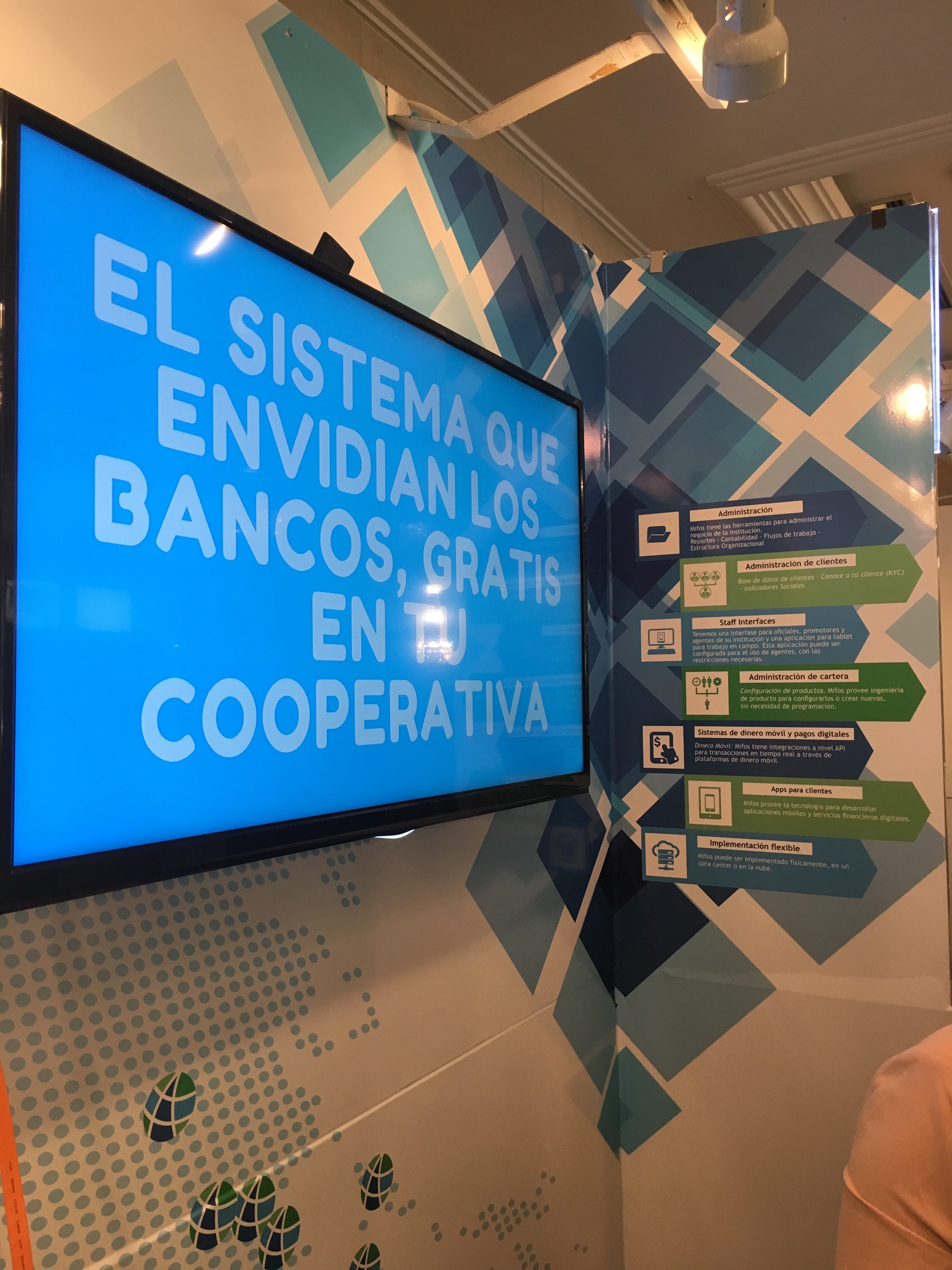

The Quito Mifos Chapter is looking forward to more participation in local fintech and financial inclusion events and will soon be hosting its own events to advanced thought leadership in financial inclusion and hackathons to promote innovations in technology for financial inclusion.

uld have on these rural areas.

uld have on these rural areas.